Do you want to retire rich? Read our beginner’s guide to financial literacy with 7 must-read books. Financial literacy is the understanding of money management, financial goals, and financial services.

It’s about knowing how to budget, save money, make financial decisions, and much more. Much like basic literacy, financial literacy is essential for living life today and planning for the future. While there are plenty of financial books out there, not all of them are geared toward beginners. Here are seven great reads to help you get started on your financial literacy journey:

- ‘The Automatic Millionaire,’ by David Bach.

- ‘The Simple Path to Wealth: Your Road Map to Financial Independence and a Rich, Free Life,’ by JL Collins

- ‘Get Good With Money: Ten Simple Steps To Becoming Financially Whole,’ by Tiffany ‘The Budgetnista’ Aliche

- The One-Page Financial Plan by Carl Richards

- ‘You Are a Badass at Making Money: Master the Mindset of Wealth,’ by Jen Sincero

- ‘The Millionaire Next Door,’ by Thomas J. Stanley, and

- ‘Broke Millennial Takes On Investing: A Beginner’s Guide To Leveling Up Your Money,’ by Erin Lowry

Financial literacy allows individuals to make well-informed financial decisions that help them meet their goals. It also helps them deal with unexpected financial challenges and avoid expensive mistakes.

Financial independence is all about having options. The more financially literate you are, the better equipped you’ll be to make money decisions that allow you to make progress toward your goals—whether it’s saving for an emergency fund or investing for retirement.

What is financial literacy?

Before moving forward we need to understand the term Financial Literacy. Financial literacy is the capacity to make wise financial decisions and take actions that promote prosperity and security financially. People that are financially literate are better able to manage their finances and make wiser judgments.

People who are financially educated can comprehend personal finance, budgeting, investing, credit, debt, and insurance better. They can prepare for their future objectives and make wise financial judgments. They may be able to achieve financial security and independence as a result. Everyone should be financially literate since it enables them to understand how money works and to make wise financial decisions. There are several strategies to develop financial literacy.

You can find advice on personal finance topics by reading personal finance books, watching films on investing or budgeting, or visiting websites dedicated to financial education. Making wiser financial judgments is possible with the aid of these methods, which may teach you about the numerous facets of finance.

Why is financial literacy important?

The importance of financial literacy cannot be overstated. It can assist people in developing sound financial judgement and money management abilities. Financial literacy makes it simpler for people to comprehend and handle their finances more skillfully. This can assist them in developing a strategy for reaching their financial objectives and safeguarding themselves from fraud, con artists, and other financial threats. Financial literacy essentially makes managing money simpler and more pleasurable.

Why Should I Read Books About Personal Finance?

Financial literacy books can be a valuable resource for personal finance enthusiasts of all ages. Reading books about finances can help you understand basic financial concepts and terms, develop financial habits, and become more financially aware. But investing in financial literacy books isn’t just beneficial for adults; kids can also benefit from reading financial literacy books as they can learn important life lessons, such as budgeting and saving money, investing, and planning for retirement.

Besides, reading books about personal finance enables people to develop financial literacy skills, understand different financial products, and make informed financial decisions.

Moreover, reading books about personal finance can help build financial literacy among the younger generation by providing them with valuable insight into how to manage money wisely.

What Are Some Examples of Financial Literacy?

For financial success, financial literacy is essential. It covers a wide range of financial topics, including managing debt and managing banks in addition to investing and budgeting. People can make wiser financial decisions and reach their financial objectives by having a basic understanding of finance.

An individual can become financially responsible and confident about their finances by having a basic awareness of financial principles like budgeting, investing, and saving.

Additionally, it teaches them sound financial practises and effective debt management. Credit cards are a further part of financial literacy. To make wise financial decisions, people must thoroughly comprehend credit card terms, interest rates, and obligations. They must also be aware of tax laws and regulations in order to manage their money wisely.

The 7 best books on financial literacy for beginners

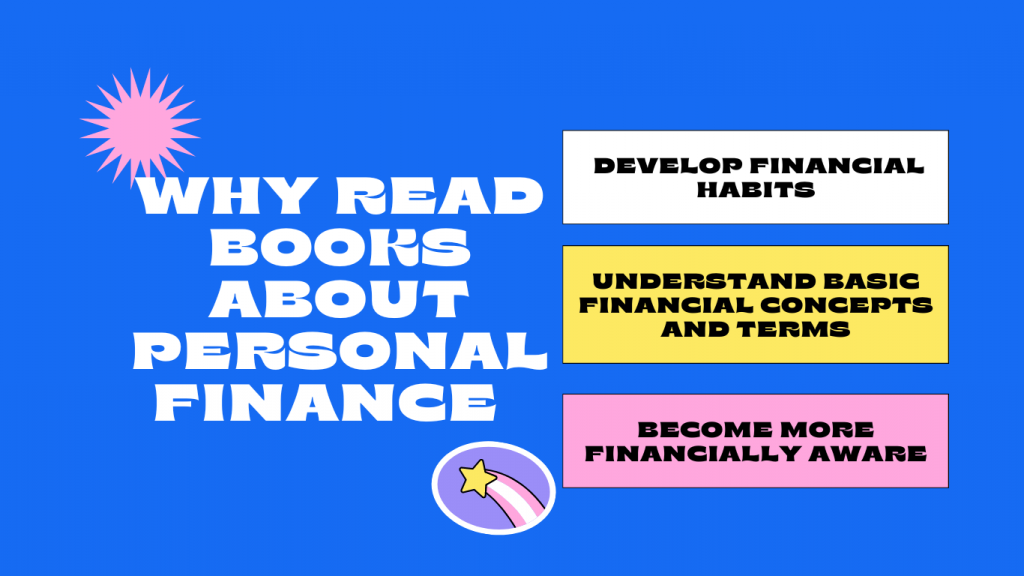

The books listed below are great financial literacy resources for beginners. They tackle a variety of financial topics, from budgeting and saving money to investing and debt management. Each book provides valuable insight on these topics, with the Automatic Millionaire being a great place to begin if you’re new to financial literacy. The book teaches you the basics of personal finance and investing, helping you make financial decisions in a way that is practical and effective.

The Simple Path to Wealth by JL Collins is another great book for beginners. It covers a wide range of financial topics, including budgeting, investing, and retirement planning. The book emphasizes the importance of setting goals and making financial decisions based on your long-term goals and values. It also discusses different financial products, such as bank accounts and credit cards, in detail so that readers can make informed financial decisions.

Get Good With Money: Ten Simple Steps To Becoming Financially Whole by Tiffany ‘The Budgetnista’ Aliche is another great book for beginners when it comes to personal finance. It provides step-by-step guides on budgeting, investing, debt management, and other aspects of financial life. The book focuses on how personal finance affects our lives rather than how much money we make or how much we spend, providing valuable financial education for everyone regardless of their financial situation.

The book The One-Page Financial Plan by Carl Richards is also worth reading as it gives beginner personal finance tips that can be adapted in different situations. It talks about budgeting and investing but also discusses other important topics like banking norms and policies and credit card usage in a simple manner.

Lastly, You Are a Badass at Making Money: Master the Mindset of Wealth by Jen Sinc

‘The Automatic Millionaire,’ by David Bach

The book, The Automatic Millionaire, by David Bach is a great resource for anyone looking to learn more about investing and achieving financial freedom. It provides readers with the tools they need to achieve success in investing and offers advice on how to make wise financial decisions.

Besides, the book covers topics such as budgeting, debt management, and retirement planning. If you are looking for a book that will help you build your personal finance knowledge, The Automatic Millionaire is definitely worth checking out.

‘The Simple Path to Wealth: Your Road Map to Financial Independence and a Rich, Free Life,’ by JL Collins

The Simple Path to Wealth by JL Collins is a great primer for people who want to become financially literate. Collins presents financial concepts like investing, budgeting, and wealth creation in this book in an approachable manner that everyone can grasp, regardless of their level of financial literacy.

The methods to achieving financial independence are thoroughly outlined in the book, which is grounded in reality rather than short-term objectives. Collins, for instance, advises investing in low-cost index funds that prioritise large and mid-sized companies rather than concentrating on high-risk or speculative stocks. His suggestions are based on a long-term objective of financial independence rather than on quick rewards. This approach helps people save money over the long term while reducing risk and investing wisely.

‘Get Good With Money: Ten Simple Steps To Becoming Financially Whole,’ by Tiffany ‘The Budgetnista’ Aliche

A financial literacy book called “Get Good with Money” encourages readers to have a positive relationship with their money and create a stable financial future. The book covers subjects including comprehending credit, creating a savings strategy, and constructing an emergency fund and offers straightforward techniques for achieving financial stability. It also offers helpful guidance on setting up a budget, investing, and coming to wise financial decisions. “Get Good with Money” is a great tool for newcomers who wish to learn about money management and become financially literate. Anyone interested in bettering their financial status or achieving their goals should start with this book.

The One-Page Financial Plan by Carl Richards

The One-Page Financial Plan by Carl Richards is a great book for beginners interested in learning about financial literacy. The book covers a range of topics, including investing, budgeting, and retirement planning in an easy-to-understand way. It gives simple steps that beginners can take to begin building wealth and avoiding common money mistakes.

Additionally, it provides guidance on setting and achieving financial goals.

Overall, this book is perfect for those who are just starting with their finances and looking to learn more about managing their money.

‘You Are a Badass at Making Money: Master the Mindset of Wealth,’ by Jen Sincero

You Are a Badass at Making Money is a great book to read if you’re just getting your financial literacy started. It goes over the fundamentals of comprehending money and creating a positive relationship with it.

The book walks readers through the process of comprehending how money functions and the reasons behind its necessity. It provides helpful guidance on how to set aside money for savings, invest, and reach financial objectives.

Additionally, it addresses matters like investment and debt management, providing insightful guidance for those wishing to better manage their personal money. Plus, “You Are a Badass at Making Money” is a pleasant and simple book to read because to Jen Sincero’s engaging writing style.

‘The Millionaire Next Door,’ by Thomas J. Stanley

The classic work on financial literacy for novices is “The Millionaire Next Door” by Thomas J. Stanley. It investigates the behaviours and mindsets of the wealthy and offers guidance on how to emulate their strategies for success.

The author looks at the methods employed by millionaires to accumulate their riches as well as the typical errors that people commit when handling their finances. Budgeting, investment, and retirement planning are among topics covered in the book. The Millionaire Next Door is a wonderful place to start if you’re interested in learning more about investing and personal finance

‘Broke Millennial Takes On Investing: A Beginner’s Guide To Leveling Up Your Money,’ by Erin Lowry

For those just beginning their financial path, “Broke Millennial Takes On Investing: A Beginner’s Guide To Leveling Up Your Money” is an excellent resource. The book provides basic, easy-to-understand guidance on budgeting, investing, and debt management.

Anyone can understand the frequently difficult subject of financial literacy thanks to Erin Lowry’s engaging writing style. This book has something to offer everyone, from the novice financial planner to the seasoned professional.

It addresses subjects including retirement planning, insurance, equities, and mutual funds and offers practical examples to help readers understand how to apply what they learn to their own financial situations.

Saving and Investing

If you want to save and invest responsibly, it’s vital to understand the basics of saving and investing. Start by understanding the concepts of saving and investing, such as the basic concept of risk tolerance, the power of compounding interest, asset allocation, and diversification. Understand how these concepts help you make financial decisions in your life. For instance, someone with a high risk tolerance can invest in higher-returning financial assets such as stocks or bonds.

As for asset allocation, it refers to the mix of financial assets a person holds. Selecting an appropriate asset allocation is important as it helps reduce overall financial risk and maximize return on investments. It also helps address personal goals, financial goals (i.e., retirement), and financial risk capacity It is vital to educate yourself on various investment vehicles such as stocks, bonds, mutual funds (i.e., money-pooled investments), and exchange-traded funds (ETFs).

Stocks are considered to be equity investments that offer ownership stakes in companies via shares. Bonds are debt investments that provide loans to companies or governments with a promise to pay back the loan with interest over time. Mutual funds are pooled investments that typically invest money from many investors in a single fund. ETFs are similar to mutual funds but they trade like a stock on an exchange like stocks do. A financial planner or other expert can guide you through investing efficiently and effectively.

Strategies to Improve Financial Literacy Skills

Understanding the fundamentals of investing and portfolio diversification is essential for developing financial literacy. You’ll get a better return on your money by investing in stocks and mutual funds as opposed to putting it in a savings account or using credit cards. In addition, you can think about investing in gold or real estate.

Before making any financial decisions, it’s crucial to conduct study because each of these investments has unique objectives, risks, and benefits. Budgeting and money management are made easier by wise use of loans and credit cards. Start by comprehending the conditions of your credit card agreement, including the interest and fee schedule.

Creating savings plans is essential to long-term wealth accumulation. Establishing a budget and tracking spending will help you make smart financial decisions for the future. Also, read financial books, podcasts, and videos to learn more about financial topics.

Financial Literacy Is Changing Communities for the Better

Financial literacy is all about understanding the basics of finance and investing, such as budgeting, savings, and investing. It also entails understanding ethical financial practices and how to use credit responsibly and minimize debt.

Financial literacy can help build financial security over time by using smart investment strategies. This could include investing in stocks, bonds, and other financial instruments. You could also consider investing in goals such as saving for retirement or starting a business.

You could also take steps to protect yourself from frauds and scams. This could involve researching financial products and services thoroughly before investing your money. You could also consider taking out insurance policies or joining financial empowerment programs if you feel you might be at risk of financial exclusion or exploitation.

Tools to help with financial literacy

A great way to learn financial literacy is by reading books that teach basic money-managing principles and investing and retirement planning.

You can choose books that focus on budgeting and saving, such as personal finance books for different life stages, such as college students or retirees.

You can also research personal finance books for different topics, such as investing or credit and debt management. Reading books about finance will help you understand financial concepts and make better financial decisions. By learning about personal finance, you can become more knowledgeable and empowered when it comes to finances.

Frequently Asked Questions

What are the basic financial literacy?

Financial literacy is the understanding of financial concepts and money management principles. It involves having knowledge and basic understanding of budgeting, investing, credit management, retirement planning, tax planning, insurance and other personal finance-related topics.

Having a good financial literacy foundation is important in order to make informed financial decisions, as this will help you understand how to save money, plan for your future goals and build wealth over time. For example, investing money wisely through mutual funds or stocks can help you accumulate more money over time.

Understanding budgeting basics can help you keep track of where your money is going and make sure that you are living within your means.

Furthermore, credit management and debt management skills can be invaluable tools when it comes to managing debt and building credit history.

Overall, having financial literacy provides you with the ability to make smart financial decisions which can ultimately lead to financial independence.

What topics should I focus on to gain a better understanding of financial literacy?

To gain a better understanding of financial literacy, you should focus on the following topics to ensure that your financial knowledge is comprehensive and up-to-date:

- Budgeting and Saving: Understanding the basics of budgeting and saving money is essential for financial literacy. You'll need to know how to plan for future expenses, set money goals, make budgeting a habit, and stay on track with investing goals.

- Investments, Taxes and Credit Scores: Knowing about investments, taxes and credit scores will help you make informed financial decisions. Learn about different types of investments, understand personal taxation laws and how to best manage debt and credit score responsibly.

- Insurance and Retirement plans: Developing an understanding of various insurance policies and retirement plans is key in order to adequately prepare for life’s financial burdens.

- Asset Classes: Researching stocks, bonds, mutual funds, real estate and other asset classes can help you build financial literacy by teaching you how to evaluate different types of investments in order to make the best financial decisions.

What are some of the best books for beginners to read on financial literacy?

If you are a beginner who is just starting to explore financial literacy, there are many books that can help you understand the basics of budgeting, investing and money management.

One book that’s great for beginners is The Automatic Millionaire Homeowner by David Bach. This book is written in an easy-to-understand way and helps readers understand the power of homeownership as an asset. It provides detailed steps on what to do next with your money, so that investing in real estate turns out to be beneficial.

Another excellent book for financial literacy beginners is The Millionaire Next Door by Thomas J. Stanley and William D. Danko. This book offers great insight into achieving wealth and personal finance success, by learning from real-life millionaires who have achieved financial independence through prudent investing and budgeting decisions. Highly recommended!

How can I practice and apply the concepts discussed in financial literacy books?

If you're looking to practice and apply the financial literacy knowledge you've acquired from books, here are some great ways to start:

- Create a budget and track your spending – this will help you understand where your money is going and help you make better financial decisions.

- Use compound interest calculators online to gain an understanding of how investing money can grow over time with compounded interest rates.

- Pay off all your debt as soon as possible, starting with the ones with the highest interest rates first in order to save money on interest payments.

- Take the time to research different types of investments and explore ways to diversify your portfolio for maximum financial protection.

- Lastly, set realistic financial goals for yourself and stick to them.

This way, you'll be motivated to remain consistent in achieving financial freedom.

Are there any online resources or tools to help me understand the topics discussed in financial literacy books?

Yes, there are plenty of online resources and tools available to help you understand the topics discussed in financial literacy books. These resources can act as a great supplemental material while you’re reading up financial books.

Websites such as Investopedia, Mint, and Nerdwallet are some of the most used platforms for budgeting, investing, retirement planning, credit management and more. Here you can find articles, calculators, quizzes and more to help you understand financial concepts.

Many financial literacy books offer additional materials on their websites which can be accessed online. This can consist of interactive financial simulations, financial literacy games or online courses that make finance more fun and exciting to learn! So if you want to gain a better understanding of financial literacy topics, then check out these online resources and tools at your disposal.

What strategies can I use to understand and apply the principles of financial literacy?

To understand and apply financial literacy, you can use a variety of strategies.

Firstly, you should start by learning the basics of personal finance such as budgeting, saving, investing and debt management. This will help you gain an understanding of different financial products and services that are available to you and how they work. You should also understand the different types of investments available to you and learn how to analyze risk when investing your money.

Furthermore, it is important to develop strategies for managing debt including setting up a repayment plan or budgeting for long-term goals. In addition, make sure to utilize financial resources and online tools such as budgeting apps or financial calculators to help track your expenses and build wealth.

Lastly, reading books on financial literacy can be beneficial in gaining a better understanding of personal finance concepts.

Conclusion

Financial literacy is a skill set that every individual should possess. It is vital for individuals to understand money management, financial planning, budgeting, credit score management, and investing. Not only does financial literacy help you make better financial decisions, but it also helps you save money and invest more wisely. Besides books, there are many other resources online that can help someone learn financial literacy.

A financial planner or budgeting app can help you plan your budget better. You can learn about credit score management by checking your credit scores and reading credit card terms and conditions. You can also join personal finance Facebook groups to connect with people who share the same financial goals as you do.

Please do give your feedback on how we can improve.