The Truth about Cryptocurrency Everybody Should Know: Cryptocurrency is a term used to describe any digital or virtual currency that employs cryptography for protection. It runs without the assistance of a central bank. Developed in 2009, Bitcoin is regarded as the pioneer cryptocurrency. Since then, many different types of cryptocurrencies have been created. As a collection of bitcoin alternatives, these are frequently referred to as “altcoins.” Blockchain-based, decentralized systems are used by cryptocurrencies to keep track of transactions and control the creation of new units. Blockchains are publicly accessible distributed ledgers for recording crypto transactions and are cryptographically validated by network nodes.

The decentralized nature of cryptocurrencies prevents them from being influenced by the government or financial institutions. They are also open, which means that everyone can see the public ledger where all transactions are recorded. Market supply and demand determine a cryptocurrencies value. The value of a cryptocurrency can also be impacted by its acceptability and popularity.

How to Obtain Cryptocurrency

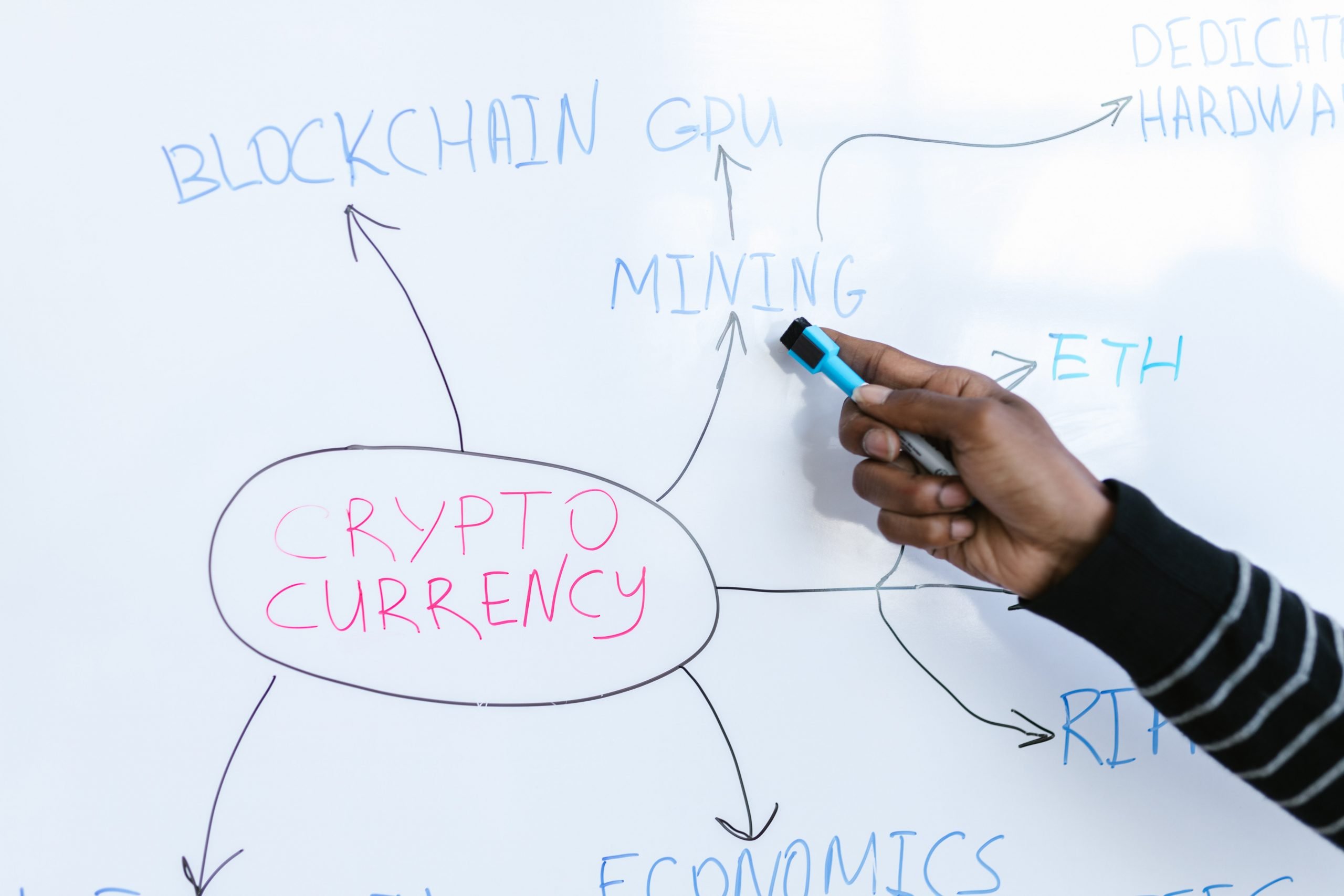

There are two ways to acquire cryptocurrencies: mining and exchange buying.

Mining

In order to validate transactions on a blockchain network, difficult mathematical equations must be solved. This process is known as cryptocurrency mining. With modest sums of the cryptocurrency they are mining, miners are rewarded for their work. The calculations become more challenging as more miners join the network, and mining requires specialized hardware and software. This guarantees both the continued security of the blockchain and the regular issuance of new coins.

Cryptocurrency Exchange

The process of buying cryptocurrencies on a virtual exchange is known as exchange buying, on the other hand. Similar to how regular stock exchanges operate, these exchanges serve as markets where buyers and sellers can trade cryptocurrencies. Individuals who wish to buy a coin on an exchange can do so using other cryptocurrencies, such as bitcoin, or fiat money like US dollars. Binance, Coinbase, and Kraken are a few of the most well-known exchanges.

It’s critical to understand that mining crypto and purchasing crypto on an exchange are two distinct operations with different properties. Mining has a high initial hardware and electricity cost, and the profits might be unpredictable. On the other hand, exchange buying is more easily available to common people and doesn’t call for specialist skills or tools. But market swings may also affect the value of the bought cryptocurrency.

Overall, the cryptocurrency process involves the use of digital wallets, mining, and cryptocurrency exchanges to acquire, manage, and use digital currencies. It allows for peer-to-peer transactions without the need for intermediaries like banks and allows for greater financial freedom and privacy.

Digital Currency Creation

Cryptocurrencies are created through the mining process. When a transaction is made on the blockchain, it needs to be verified by other participants in the network. Miners are responsible for verifying transactions, and in return, they are rewarded with new units of cryptocurrency. Miners employ specialized technology for difficult mathematical equations, much like how gold miners have to dig through the soil to find gold. The process of solving these equations is known as “proof-of-work” (PoW).

The first miner who solves the equation gets to add the next block to the blockchain and gets the reward for that block. This reward is a new unit of cryptocurrency, and it is called a block reward. Additionally, the miner also gets the transaction fee that the sender of the transaction has paid to have the transaction processed.

Different cryptocurrencies have different rules for how they are generated. For example, Bitcoin has a fixed maximum supply of 21 million, while other cryptocurrencies may have a different maximum supply or no maximum at all. Some cryptocurrencies also use different consensus mechanisms such as “proof-of-stake” (PoS) which doesn’t require solving complex mathematical equations, instead, it verifies transactions based on the number of coins held by the miner.

Pros and Cons of Cryptocurrency

Cryptocurrency has many potential advantages and disadvantages, depending on how it is used and perceived.

Cryptocurrencies can be traded freely without the need for intermediaries like banks, as was previously discussed, and are not subject to regulation by governments or financial institutions. Due to the absence of third-party involvement, cryptocurrency trading has more flexibility and security. Cryptocurrency also offers a high level of security due to its use of cryptography, making it difficult for transactions to be hacked or altered.

Another advantage of cryptocurrency is that it can be used for online purchases and international money transfers at a lower cost than traditional methods. Transactions are also faster with cryptocurrency, as they are processed and verified on the blockchain within minutes.

However, there are also several disadvantages to using cryptocurrency. One of the biggest concerns is the volatility of its value. The value of a cryptocurrency can fluctuate greatly in a short period, making it a risky investment. Additionally, cryptocurrency is not widely accepted as a form of payment, and it can be difficult to find businesses that accept it.

Another disadvantage is the lack of regulation and oversight. Cryptocurrency operates independently of government and financial institutions, which can make it a target for illegal activities such as money laundering and fraud.

Similarly, there are concerns about consumer protection, as there’s no legal recourse if something goes wrong. For example, if a user loses their digital wallet or private keys, they lose access to their funds forever, with no possibility of recovery.

The Bottom Line

Cryptocurrency is a type of digital or virtual money that lacks a central bank’s control and employs encryption for protection. It offers a wide range of possible benefits, including financial independence, security, and reduced transaction costs. Mining, which is the process of validating transactions and adding them to the blockchain, is how cryptocurrency is created. New crypto units are given to miners as payment for their work. Volatility, a lack of acceptance, a lack of regulation and monitoring, and a lack of consumer protection are some of its key drawbacks. The future of this technology is still unknown as crypto adoption and use are still in their infancy. Before investing in or using cryptocurrencies, people should consider the potential advantages and hazards. We have shortlisted 7 best cryptocurrencies for 2023 that are worth considering.